Notes

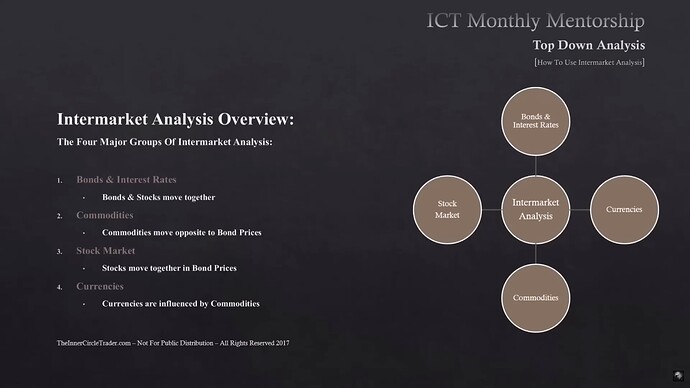

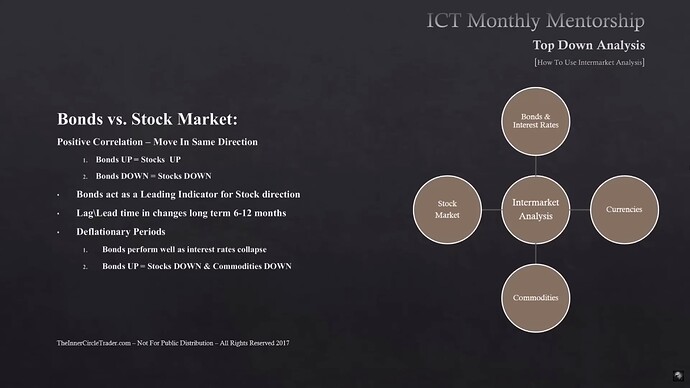

- Bonds and stocks generally move together. The bonds, not the yields.

- If you’re going to be a stock trader, you’ll want to look at the bond market as an indicator to see if you have underlying strength in it.

- If bond prices drop, then interest rates are rising. The stock market and bond markets don’t like when interest rates are rising, so they will drop.

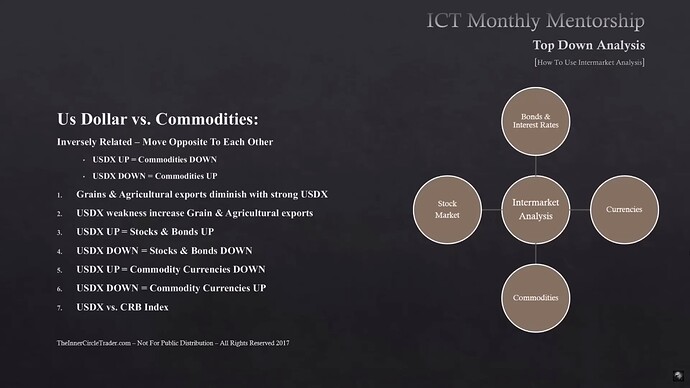

- The export sales of commodities and production affect the value of some currencies.

- CRB Commodity Index:

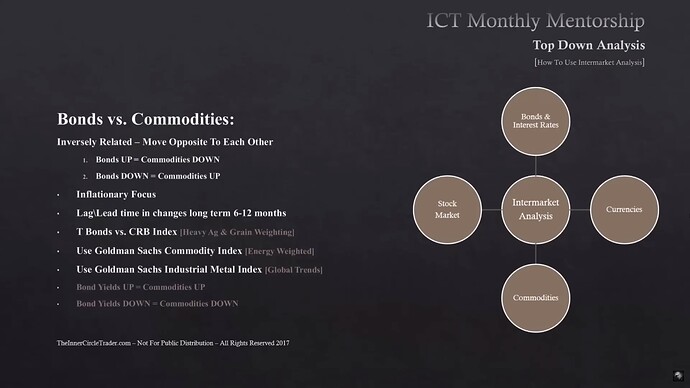

- The correlation between bonds and commodities tends to be lagged. For example, bonds can rally up, and commodities can go down later, with a 6 to 12-month lag time.

- The CRB commodity index is very heavily weighted with the agricultural and grain markets, such as soybean, wheat, corn, cattle, and hog prices.

- Goldman Sachs Commodity Index is heavily weighted with energy.

- Goldman Sachs Commodity Index:

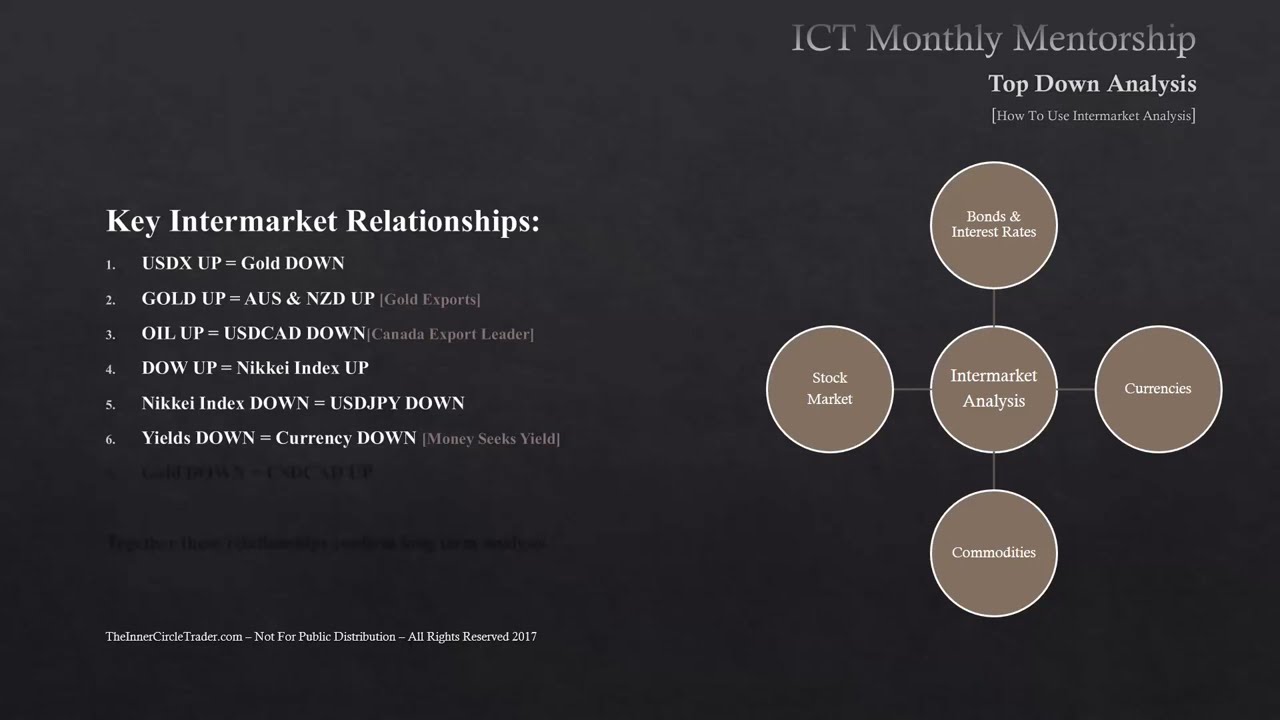

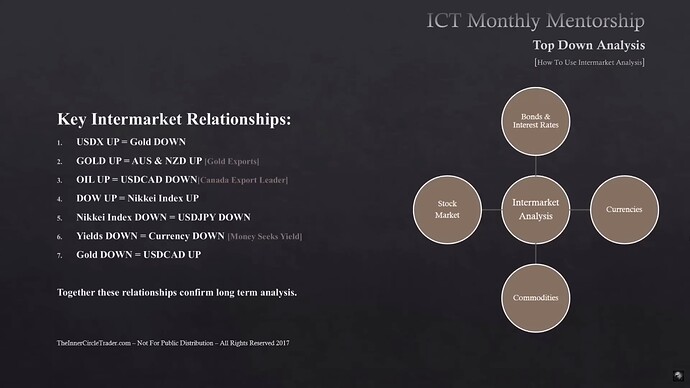

- Understanding key intermarket relationships will give you the same outcome as looking at fundamental data. However, like fundamental data, it can lag. Just because the data is released does not mean it will immediately do that. It can take some time.

How To Use Intermarket Analysis

How To Use Intermarket Analysis - Overview

How To Use Intermarket Analysis - Bonds Vs. Stock Market

How To Use Intermarket Analysis - Bonds Vs. Commodities

How To Use Intermarket Analysis - US Dollar Vs. Commodities

How To Use Intermarket Analysis - Key Intermarket Relationships

Next lesson: ICT Mentorship Core Content - Month 5 - How To Use Bullish Seasonal Tendencies In HTF Analysis

Previous lesson: ICT Mentorship Core Content - Month 5 - Interest Rate Differentials