Notes

- There is no ideal entry technique. Using limit orders can cause you to miss some trades while using stop orders increases your risk slightly.

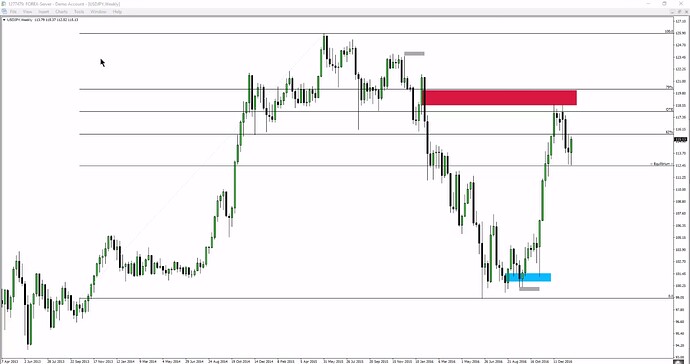

- If we look for a bullish move, we place a stop loss below the lowest low of the last 40 days. Once it moves above 50% of the trading range (equilibrium), we move the stop loss to the lowest low of the last 20 days.

- If we look for a bearish move, we place a stop loss above the highest high of the last 40 days. Once it moves below 50% of the trading range (equilibrium), we move the stop loss to the highest high of the last 20 days.

- Wider stop losses are better for long-term trading.

- If we have entered a long position, we will check every day for the lowest low of the last 40 or 20 days, depending on whether the price is above 50% of the trading range. If the new low is higher than our initial stop loss, we will move it below that low.

- If we have entered a short position, we will check every day for the highest high of the last 40 or 20 days, depending on whether the price is below 50% of the trading range. If the new high is lower than our initial stop loss, we will move it above that high.

- The lookback period is based on the knowledge from the lesson on IPDA data ranges.

Position Trade Management - Bullish Market Conditions

Position Trade Management - Bearish Market Conditions

Position Trade Management - USDJPY Weekly Chart Example

Position Trade Management - Short Trade Entry And Stop Loss Placement

Position Trade Management - Long Trade Entry And Stop Loss Placement

Next lesson: ICT Mentorship Core Content - Month 6 - Ideal Swings Conditions For Any Market

Previous lesson: ICT Mentorship Core Content - Month 5 - Limit Order Entry Techniques For Long Term Traders