Notes

- The longer the consolidation, the more orders are located at its edges.

- The direction on the daily or four-hour chart determines where the price will go after leaving the consolidation. For example, if the price on the daily chart is trending upward, we can assume that it will continue in this movement.

- If we use the daily or four-hour charts to determine direction, we will monitor the occurrence of consolidations on the hourly or fifteen-minute chart.

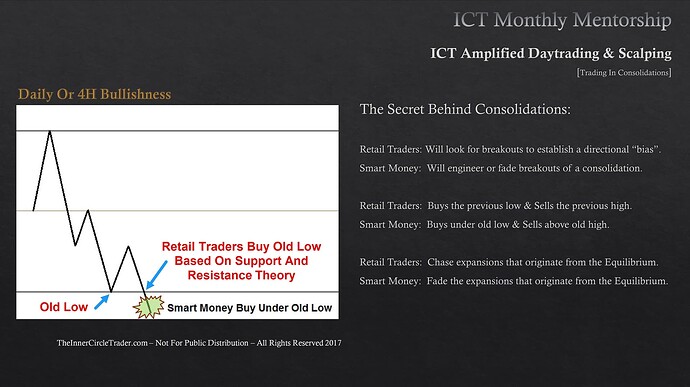

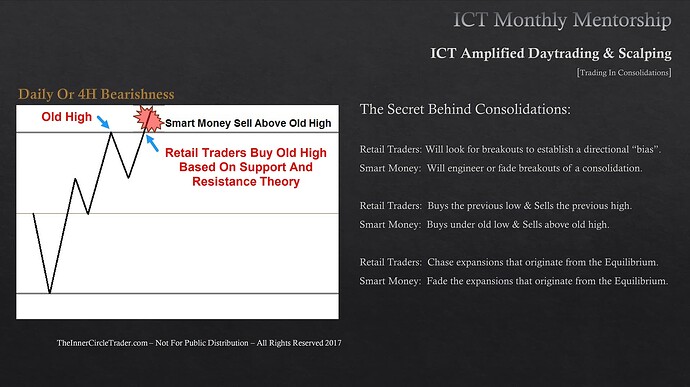

- When we buy below the old low or sell above the old high, our target is equilibrium, as we never know if the price will reach the other side of the consolidation.

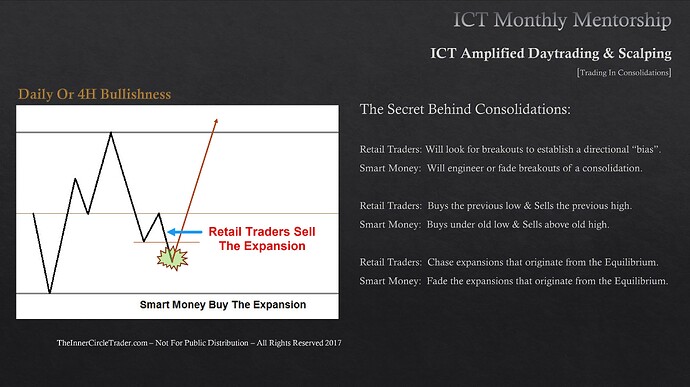

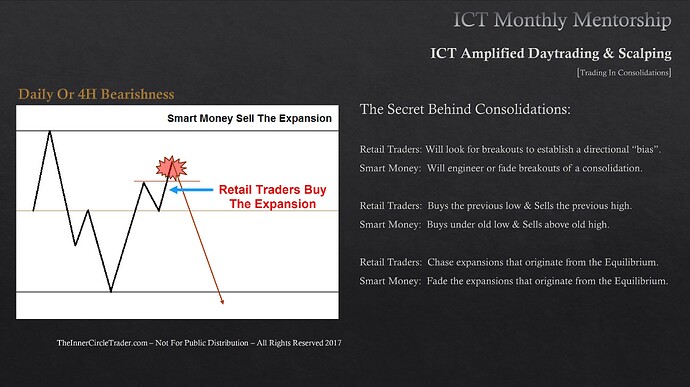

- When we buy or sell an expansion, we always target the other side of the consolidation because we are entering a trade inside its range.

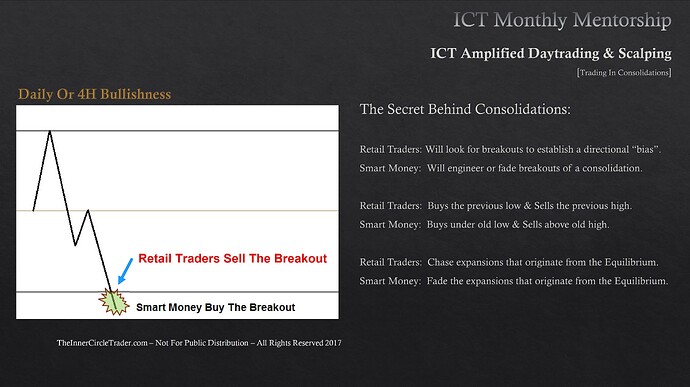

Trading In Consolidations - Smart Money Buys The Breakout

Trading In Consolidations - Smart Money Buys The Expansion

Trading In Consolidations - Smart Money Buys Under Old Lows

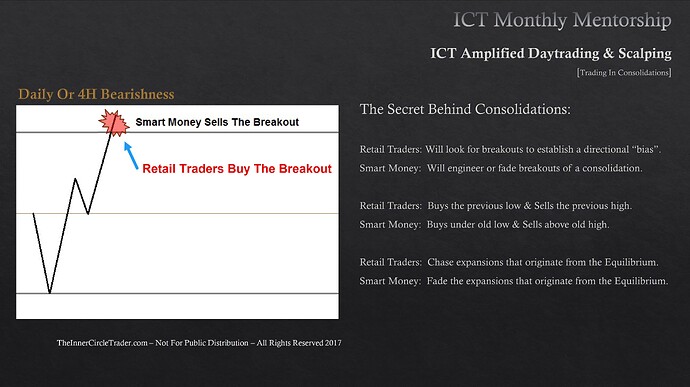

Trading In Consolidations - Smart Money Sells The Breakout

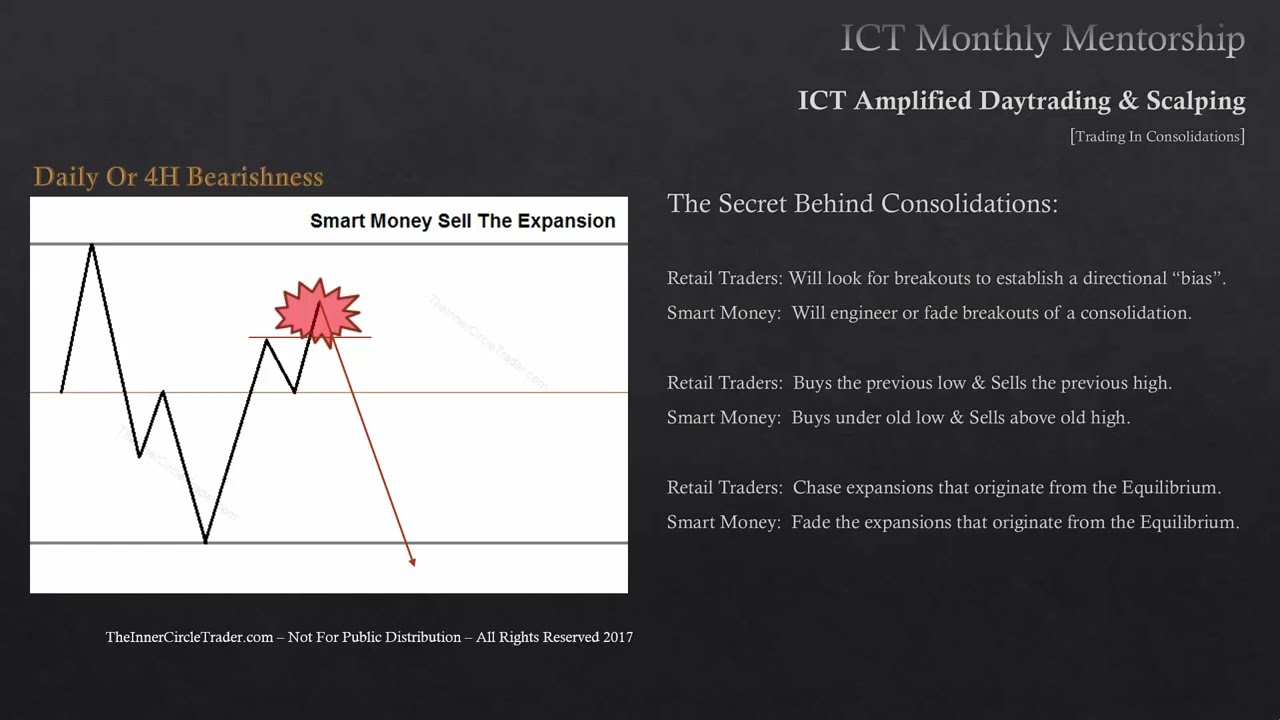

Trading In Consolidations - Smart Money Sells The Expansion

Trading In Consolidations - Smart Money Sells Above Old Highs

Next lesson: ICT Mentorship Core Content - Month 9 - Trading Market Reversals

Previous lesson: ICT Mentorship Core Content - Month 9 - 20 Pips Per Day