Notes

- Reasons for price reversal after breaking the high or low:

- A higher time frame PD array prevents further movement.

- A logical place to take profits at the end of a trend.

- Market makers engineer liquidity to put people on the wrong side of the market.

- We should always be aware of where the highs and lows of the last three days are, counting today as day one. These are good places for stop runs.

- In general, during the New York session, we expect the market to continue moving in the direction that began in the London session.

- We expect a price reversal if the market reaches the HTF PD array during the New York session.

- All the findings that apply to the New York Session are equally valid for the London Close Session.

- If we understand the context, i.e., institutional order flow, we can predict when market reversals will occur.

- We monitor institutional order flow on weekly, daily, and four-hourly charts.

- When we see overlapping reversal concepts, the trade idea becomes even stronger. For example, the New York reversal can occur simultaneously with the Intra-Week reversal.

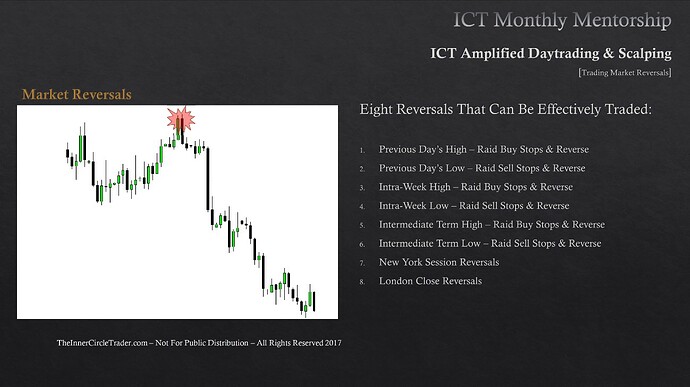

Trading Market Reversals - Eight Reversals That Can Be Effectively Traded

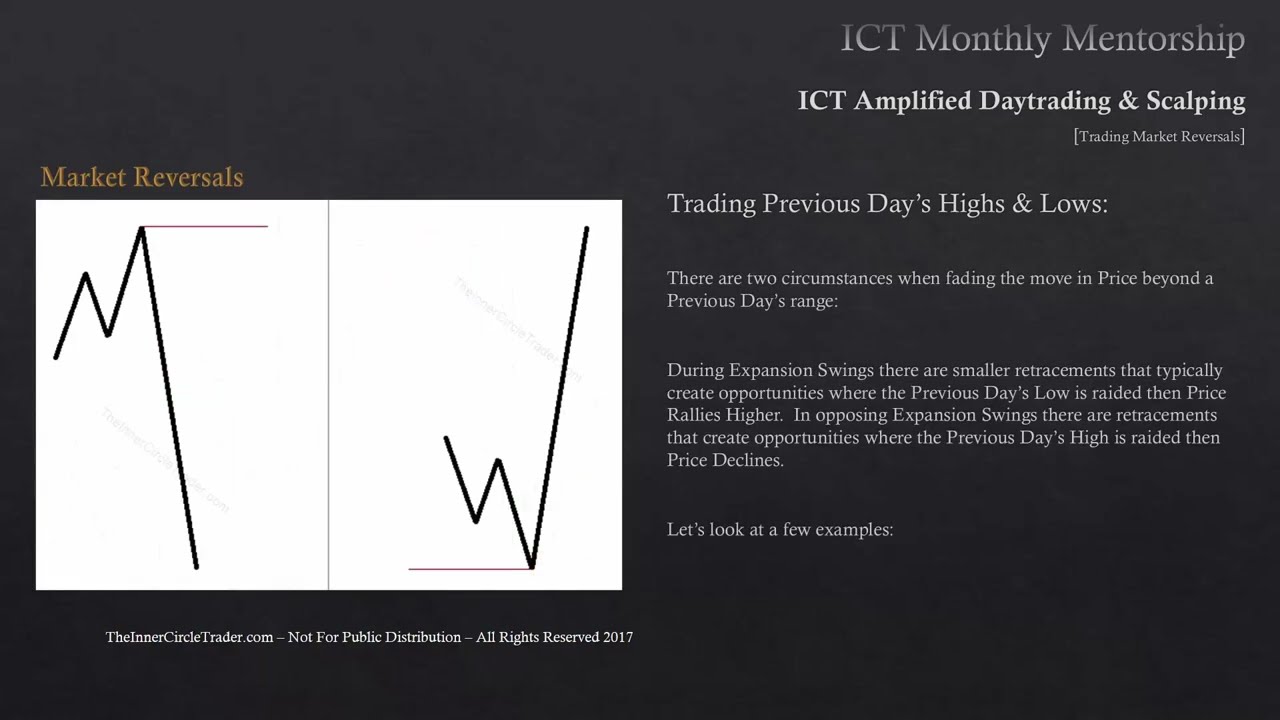

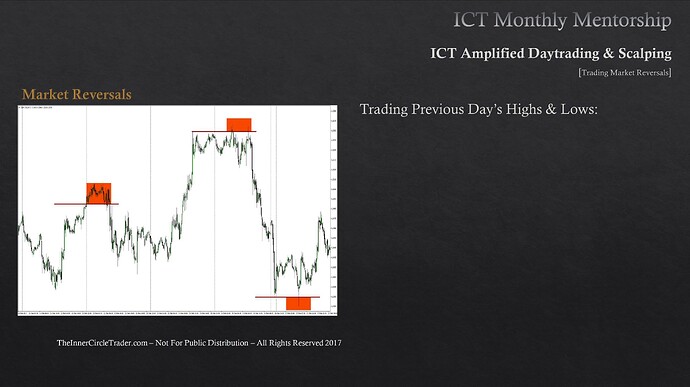

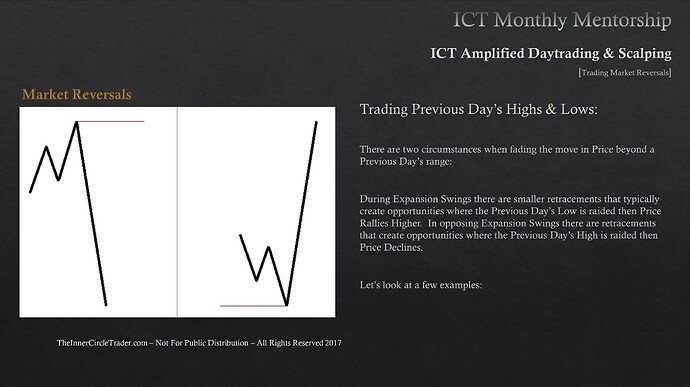

Trading Market Reversals - Previous Day’s Highs And Lows

Trading Market Reversals - Previous Day’s Highs And Lows

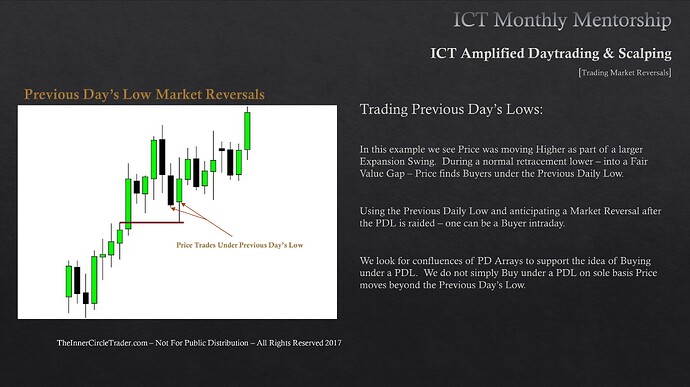

Trading Market Reversals - Previous Day’s Lows

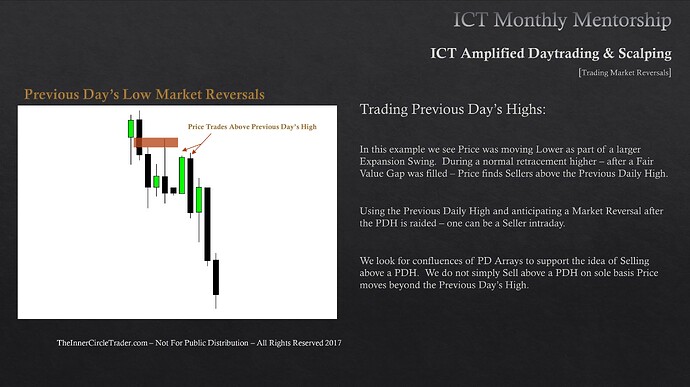

Trading Market Reversals - Previous Day’s Highs

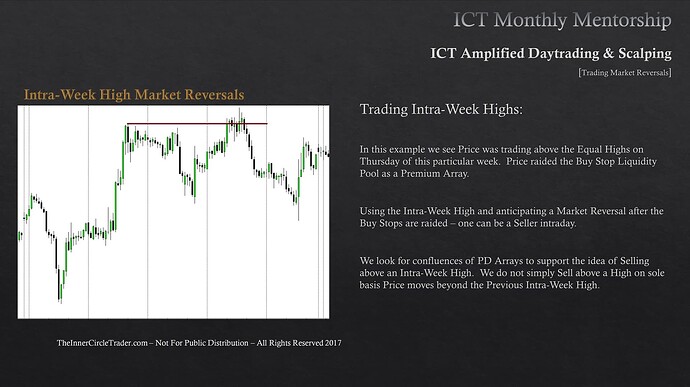

Trading Market Reversals - Intra-Week Highs

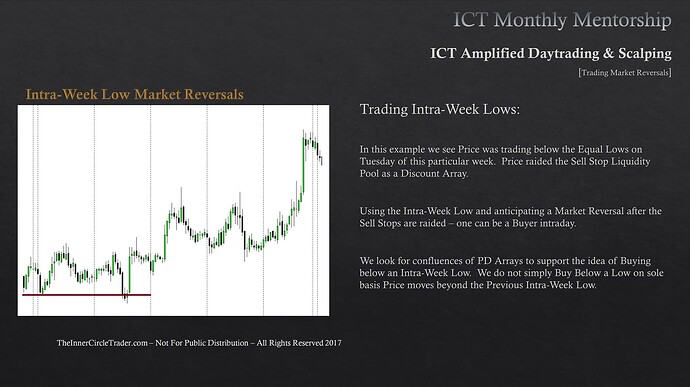

Trading Market Reversals - Intra-Week Lows

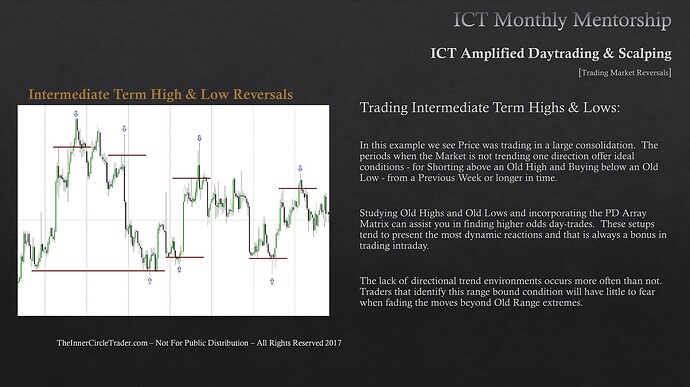

Trading Market Reversals - Intermediate-Term Highs And Lows

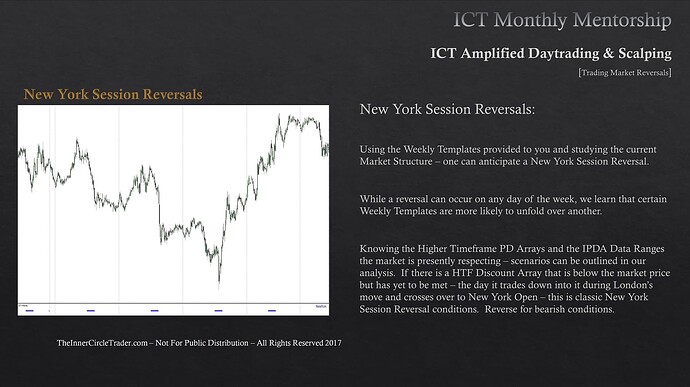

Trading Market Reversals - New York Session Reversals

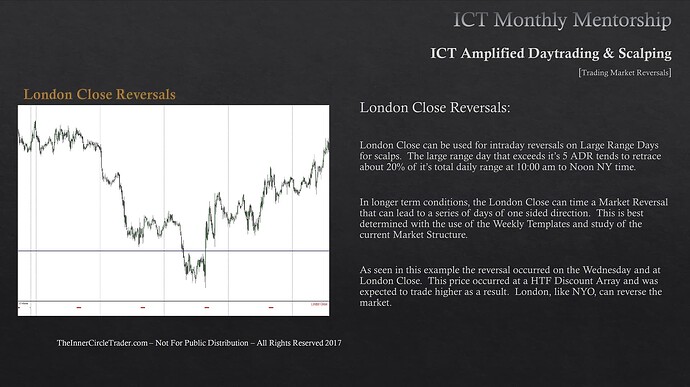

Trading Market Reversals - London Close Reversals

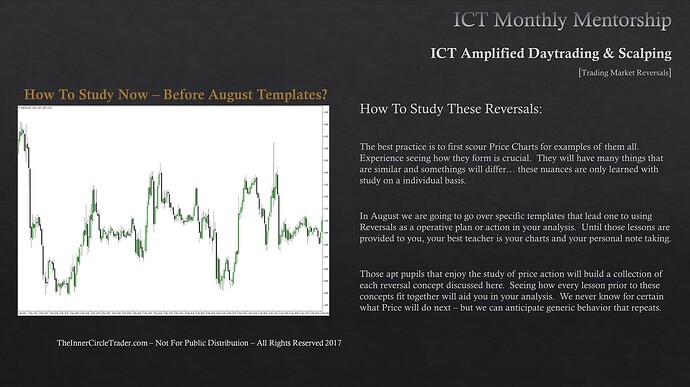

Trading Market Reversals - How To Study These Reversals

Next lesson: ICT Mentorship Core Content - Month 9 - Bread & Butter Buy Setups

Previous lesson: ICT Mentorship Core Content - Month 9 - Trading In Consolidations