Notes

- A typical trade produced by these models takes no more than two hours.

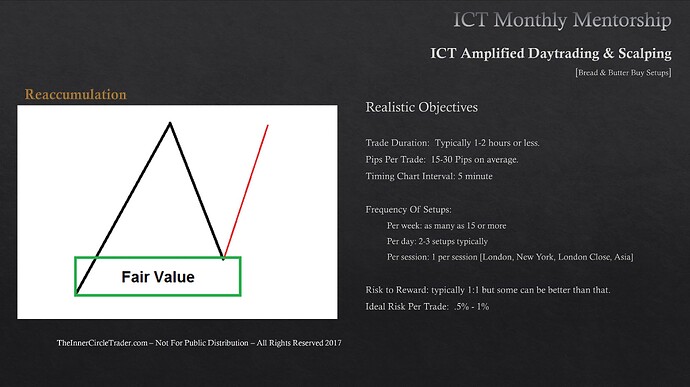

- The reaccumulation model is typically identical to the optimal trade entry (OTE).

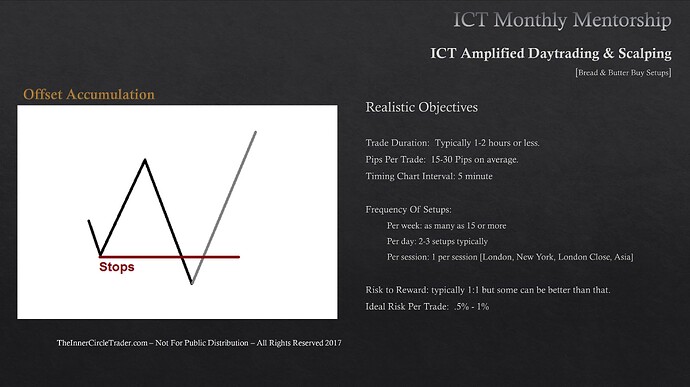

- The offset model is basically a turtle soup setup.

- Michael recommends using market orders to enter trades.

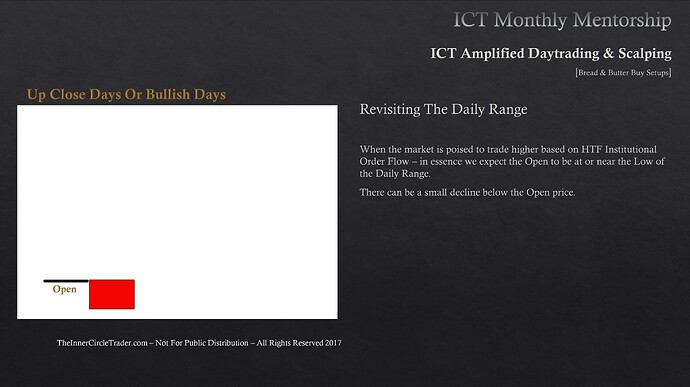

- We use an institutional order flow analysis and IPDA data ranges to determine where the price will most likely go.

- We analyze institutional order flow on monthly, weekly, daily, and four-hourly charts.

- If we expect higher prices, we want to see bearish PD arrays fail and bullish PD arrays be respected.

- If we expect lower prices, we want to see bullish PD arrays fail and bearish PD arrays be respected.

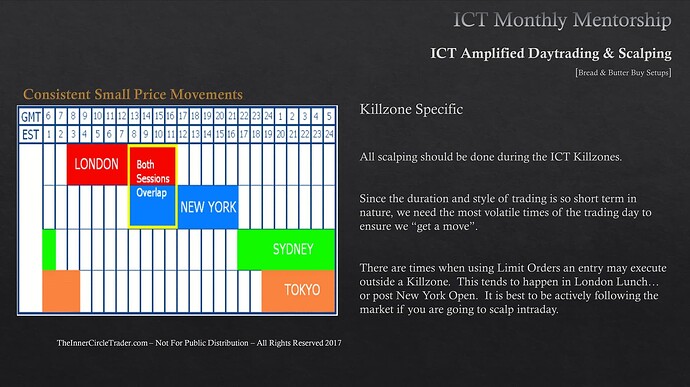

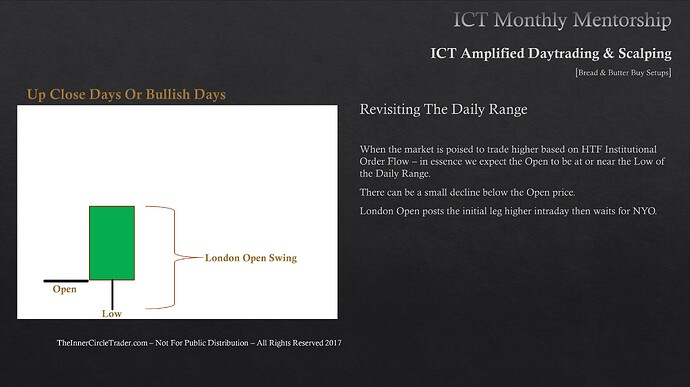

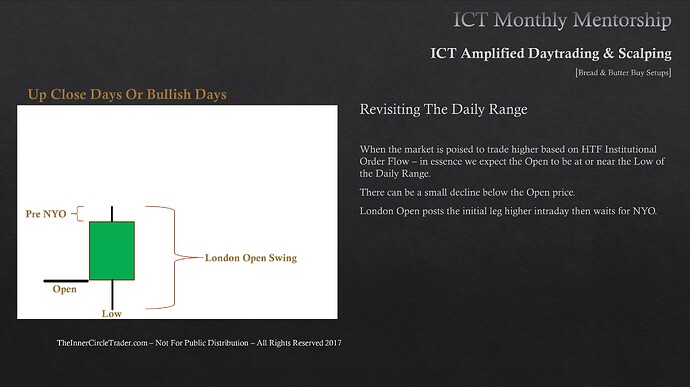

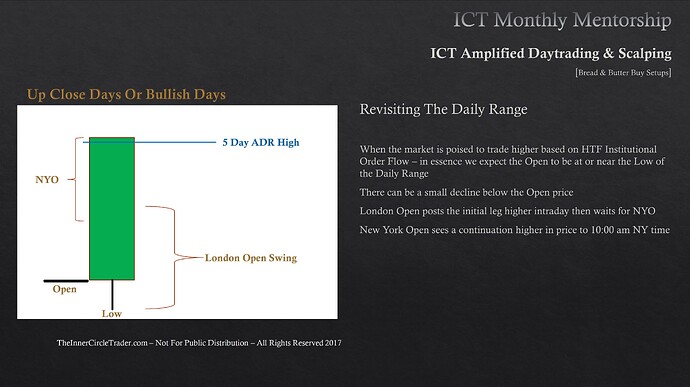

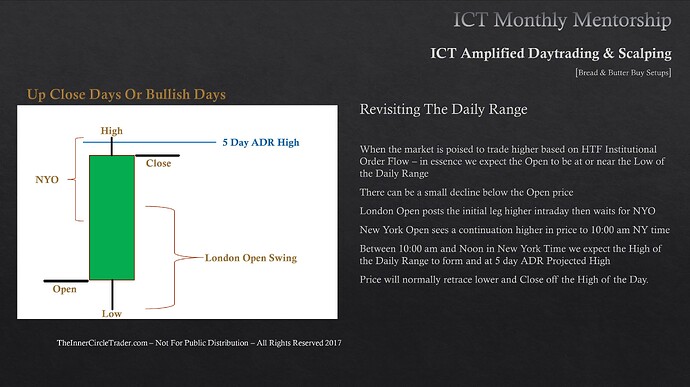

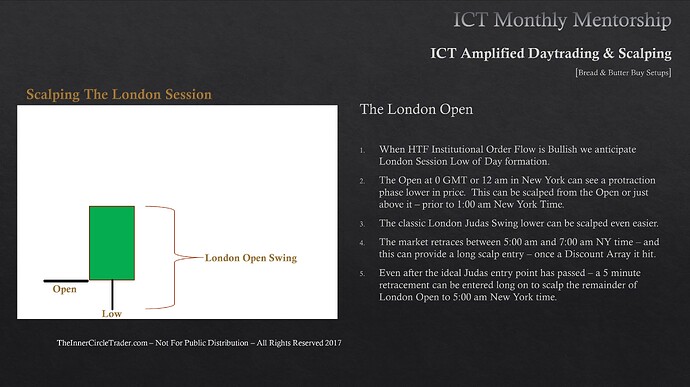

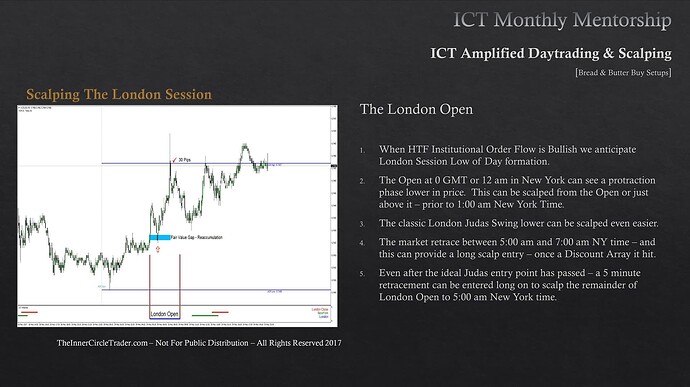

- The London open swing usually covers 40-60% of the daily range before 5 a.m.

- The market usually retraces or consolidates during London lunchtime.

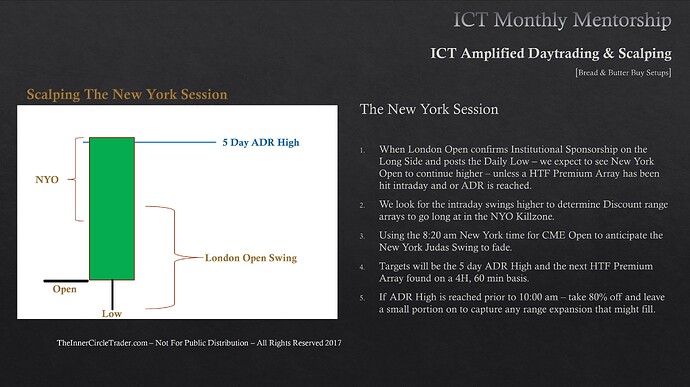

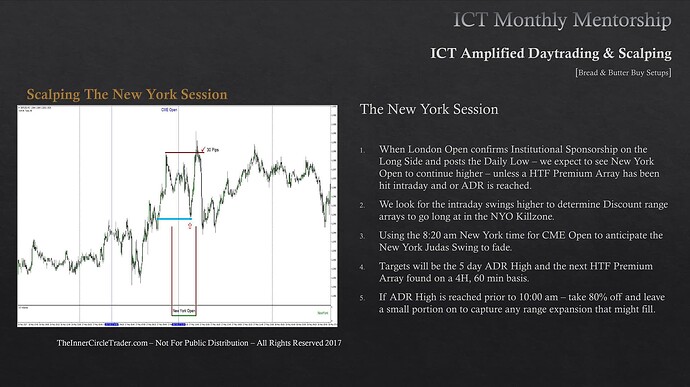

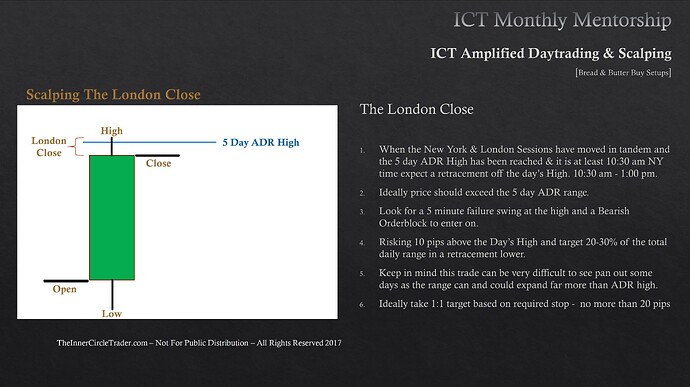

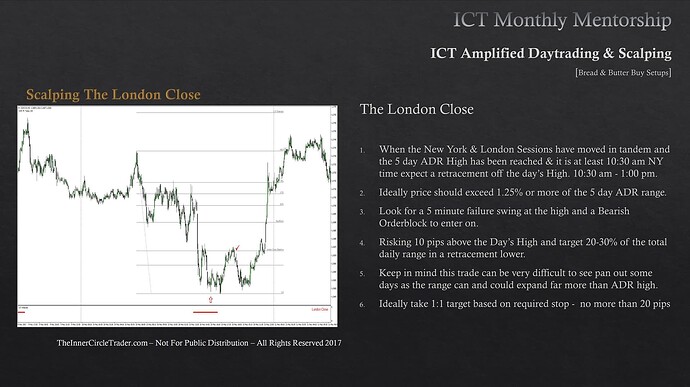

- The price should hit the five-day ADR high. Combine that with projections and PD arrays to get very precise results.

- Michael recommends trading these models on the five-minute chart.

- Every session has a protractionary market stage, a judas swing.

- Typical protraction times (EST):

- 12:00 a.m. - New York midnight.

- 8:20 a.m. - CME open.

- 10:00 a.m. - London close session start.

- 8:00 p.m. - 0:00 GMT.

- Michael no longer trades the London close session.

- Michael no longer trades forex during the London close session.

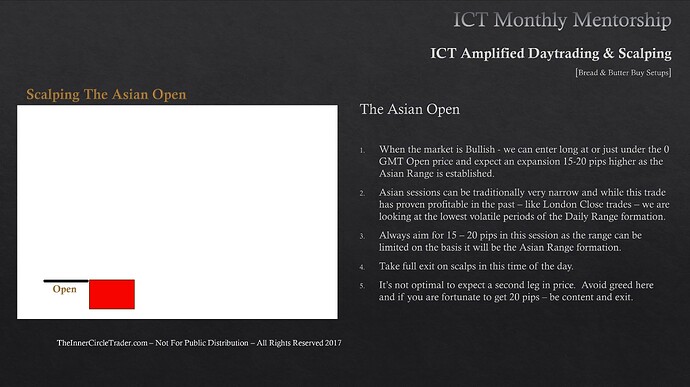

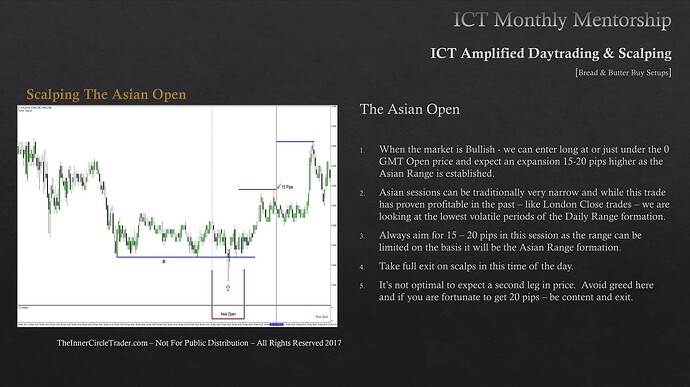

- The Asian Open and London Close sessions are probably not worth watching as they offer fewer opportunities for trading.

- Scalping opportunities for the short side are described in the Bread And Butter Sell Setups lesson.

Bread & Butter Buy Setups - Daily Opportunities In Scalping

Bread & Butter Buy Setups - Offset Accumulation

Bread & Butter Buy Setups - Reaccumulation

Offset Accumulation - Realistic Objectives

Reaccumulation - Realistic Objectives

Bread & Butter Buy Setups - Killzone Specific

Revisiting The Daily Range - Open

Revisiting The Daily Range - London Open Kill Zone

Revisiting The Daily Range - Pre-New York Open Kill Zone

Revisiting The Daily Range - New York Open Kill Zone

Revisiting The Daily Range - Close

Bread & Butter Buy Setups - Scalping The London Session

Scalping The London Session - Trade Example

Bread & Butter Buy Setups - Scalping The New York Session

Scalping The New York Session - Trade Example

Bread & Butter Buy Setups - Scalping The London Close

Scalping The London Close - Trade Example

Bread & Butter Buy Setups - Scalping The Asian Open

Scalping The Asian Open - Trade Example

Next lesson: ICT Mentorship Core Content - Month 9 - Bread & Butter Sell Setups

Previous lesson: ICT Mentorship Core Content - Month 9 - Trading Market Reversals