Notes

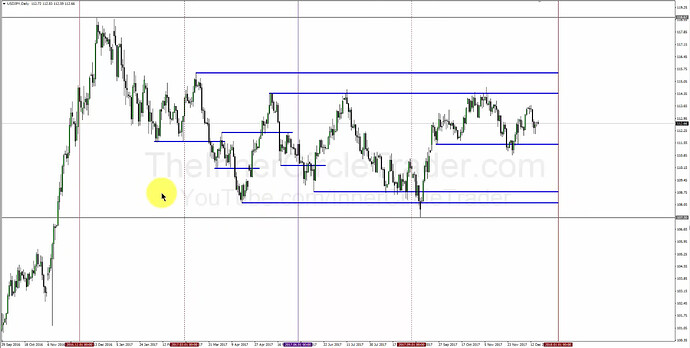

- Key higher time frame levels include yearly, monthly, and weekly highs and lows.

- Determination of key highs and lows:

- Yearly Highs and Lows:

- We use a rolling 12-month calendar from the current date to determine the highest and lowest points.

- These levels help in identifying long-term market trends.

- Monthly Highs and Lows:

- We look at the past three months and the immediate previous month to analyze market conditions.

- Important for understanding short to medium-term trends.

- Weekly Highs and Lows:

- We analyze the last week’s high and low to assess current market sentiment.

- Yearly Highs and Lows:

- Places where we expect price rejection:

- Double-Top Sweep - This occurs when the price creates equal highs and then sweeps above before rejecting and moving lower.

- Double-Bottom Sweep - This occurs when the price creates equal lows and then sweeps below before rejecting and moving higher.

- Old Highs Sweep - This occurs when the price creates a swing high and then sweeps above before rejecting and moving lower.

- Old Lows Sweep - This occurs when the price creates a swing low and then sweeps below before rejecting and moving higher.

Next lesson: ICT Forex - Market Maker Primer Course - Secrets To Swing Trading

Previous lesson: ICT Forex - Market Maker Primer Course - How To Find Explosive Price Moves Before They Happen