Notes

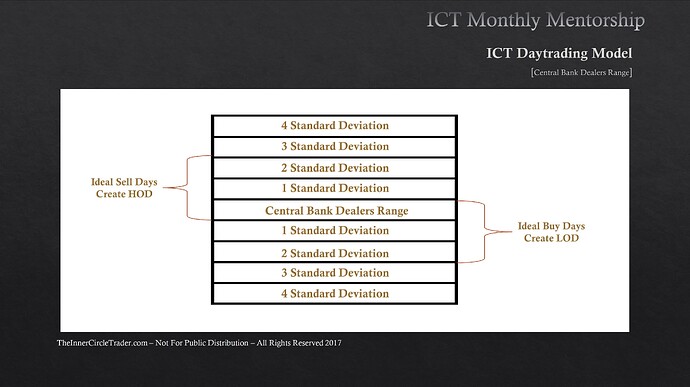

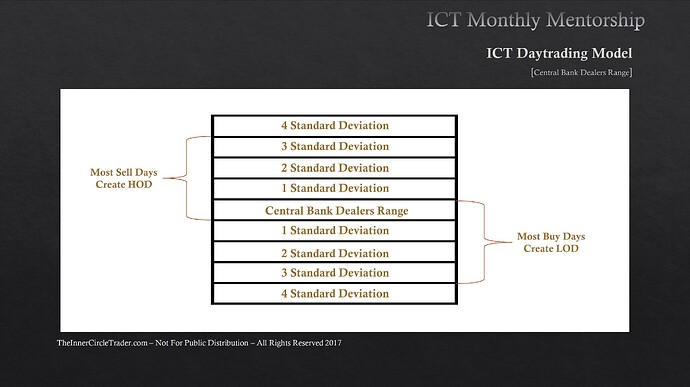

- CBDR helps determine where the high of the day is likely to form on a bearish day and the low of the day on a bullish day.

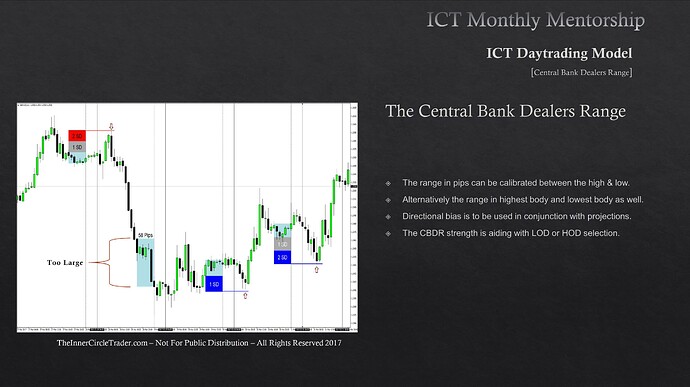

- One standard deviation has the exact size of CBDR.

- The price reaches the fourth standard deviation under these conditions:

- High-impact news during the London session.

- New York session market reversal profile.

- We can use the bodies of the candles or their wicks to denote the Central Bank Dealers Range. Michael prefers to use candle bodies because the wicks can vary from one broker to another.

- Even if we choose to use a CBDR defined by candle bodies, we should still also use a CBDR using candle wicks.

- If CBDR is greater than 40 pips, these are not suitable conditions for day trading, and we should only consider scalp trades.

- Michael stresses that he doesn’t trade every day as it is not efficient from his point of view.

- Every trading day does not offer the same opportunities. The probability of making a profitable trade is higher on some days than others.

Central Bank Dealers Range - Ideal Sell And Buys Days

Central Bank Dealers Range - Most Sell And Buys Days

Central Bank Dealers Range - Ranges Including Candle Wicks

Central Bank Dealers Range - Ranges Not Including Candle Wicks

Central Bank Dealers Range - Standard Deviations

Next lesson: ICT Mentorship Core Content - Month 8 - Projecting Daily Highs & Lows

Previous lesson: ICT Mentorship Core Content - Month 8 - Defining The Daily Range