Foundation Presentation - Part 1

Foundation Presentation - Part 2

Foundation Presentation - Part 3

Supplementary Lesson

Trade Plan

Algorithmic Theory

Notes

- Price Action Model number 6 focuses on the buy-side curve of the Market Maker Buy Model (MMBM) and Market Maker Sell Model (MMSM).

- The Market Maker Model is a universal concept that can be applied to any time frame.

- It can be used by scalpers, day traders, swing and position traders.

- Michael’s price action models build on the knowledge gained from the ICT Mentorship Core Content.

- Michael clarifies that the strategy differs from Wyckoff’s theory. Market Maker models (buy and sell) focus on institutional order flow rather than Wyckoff’s ideas of accumulation and distribution zones.

- Gold and the Dollar Index typically move in opposite directions.

- We should look for areas of accumulation, entering positions during periods of rebalancing and exiting when liquidity targets are hit.

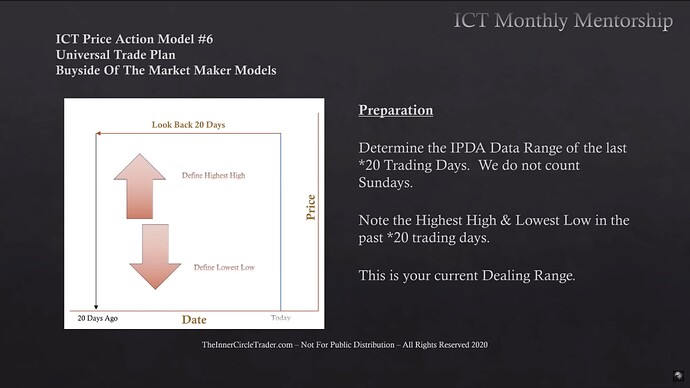

- The lookback period for the IPDA data range is chosen depending on the time frame we are looking for market maker models. For example, the 60-day range is for weekly setups, while the 20-day and 40-day ranges are typically for daily setups.

- Market Maker Models typically have two accumulation phases, but they may have only one or even none!

- If we want to pyramid into positions, there must be enough room to target that the trade makes sense from a risk/reward perspective.

- When the Market Maker Model does not offer any retracements and instead quickly moves towards buying or selling liquidity, it will probably be a stop run (turtle soup), and the price will soon head in the opposite direction.

Market Maker Buy Model - Process

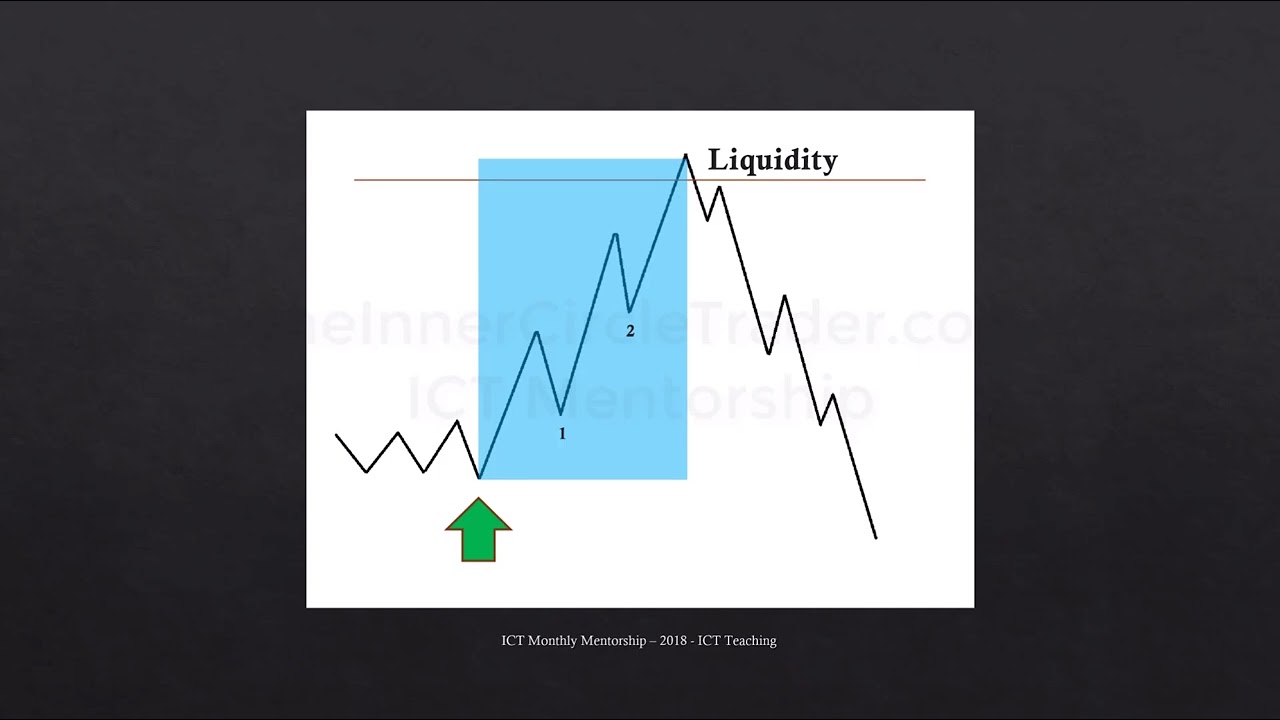

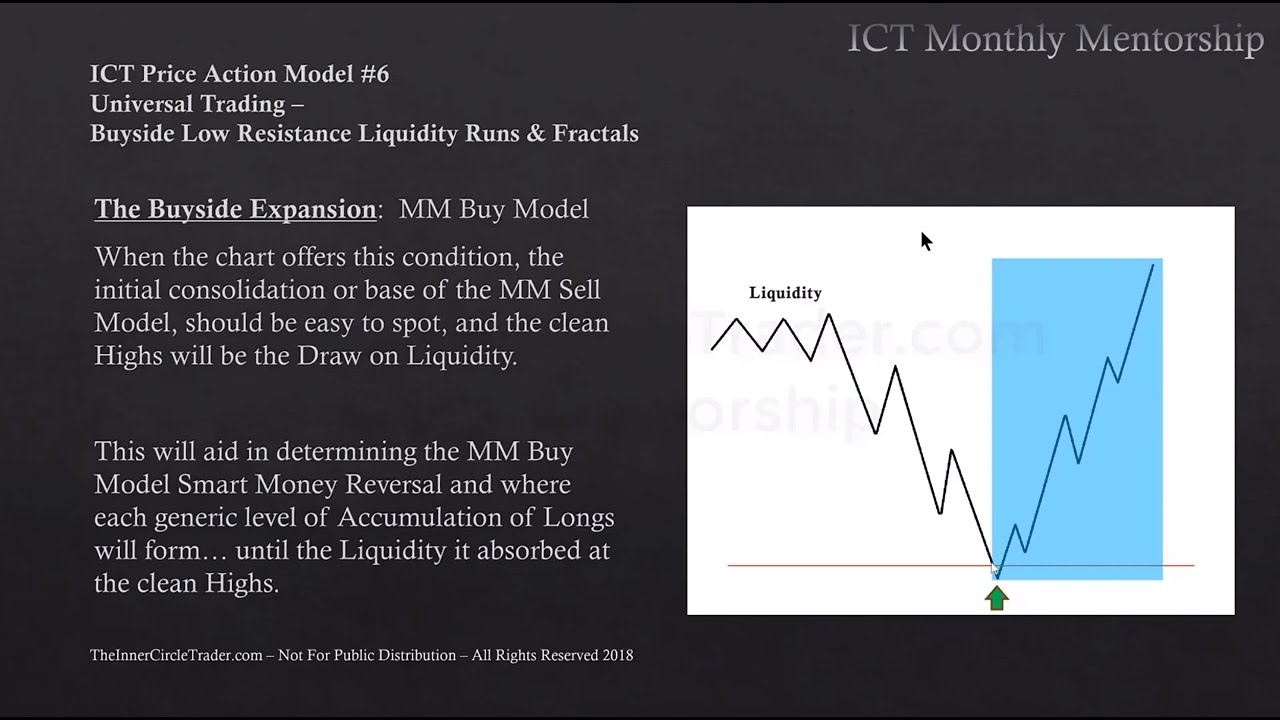

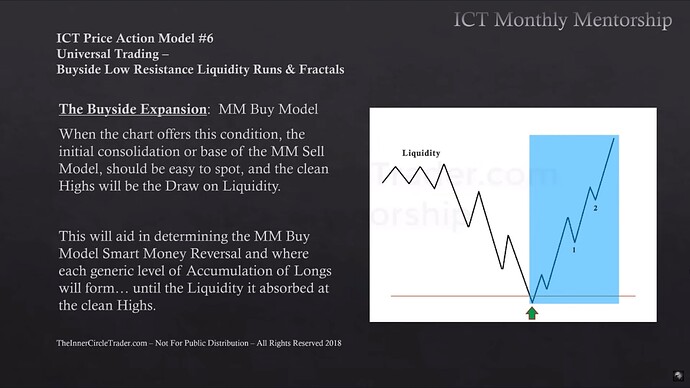

The Buyside Expansion - Market Maker Buy Model

The Buyside Expansion - Market Maker Buy Model 2

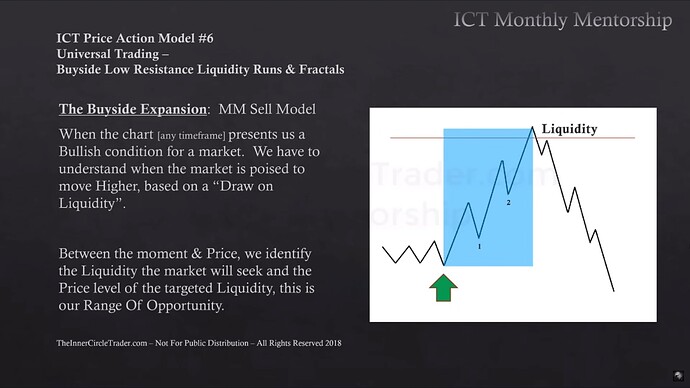

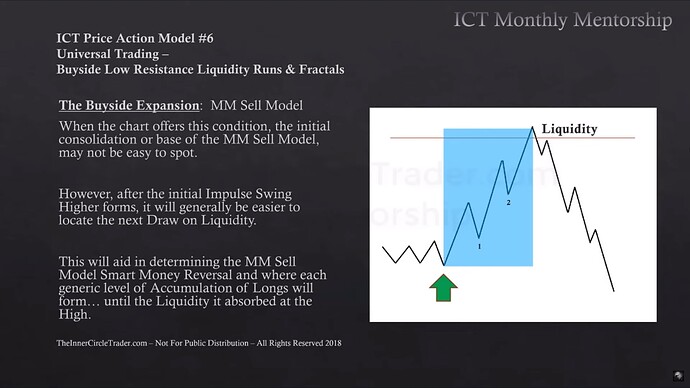

The Buyside Expansion - Market Maker Sell Model

The Buyside Expansion - Market Maker Sell Model 2

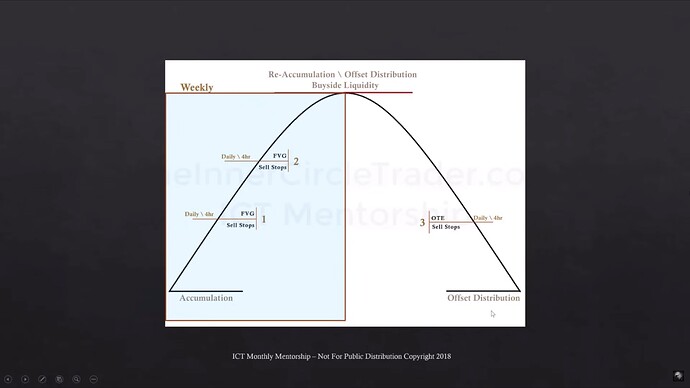

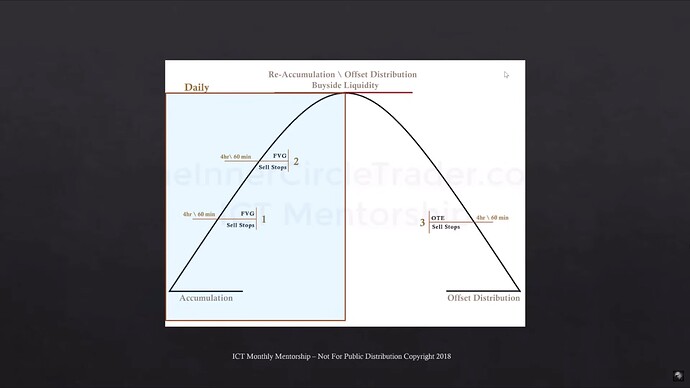

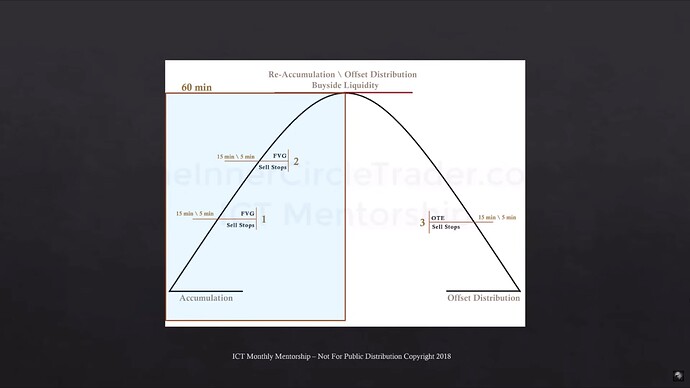

The Buyside Expansion Diagram - Weekly, Daily, 4-hour Time Frames

The Buyside Expansion Diagram - Daily, 4-hour, 60-Minute Time Frames

The Buyside Expansion Diagram - 60-Minute, 15-Minute, 5-Minute Time Frames

The Buyside Expansion - Market Maker Buy Model Diagram

GBPUSD Market Maker Sell Model - Weekly Chart

GBPUSD Market Maker Buy Model - Hourly Chart

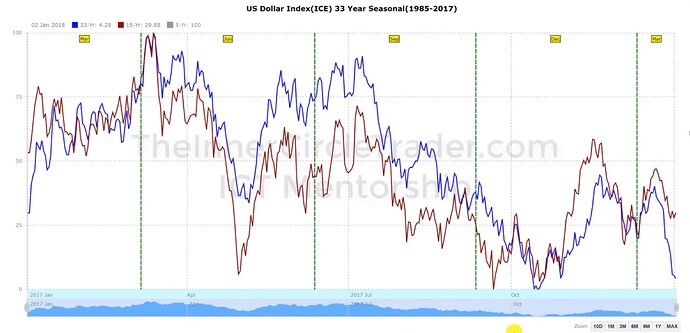

US Dollar Index Seasonal Tendencies

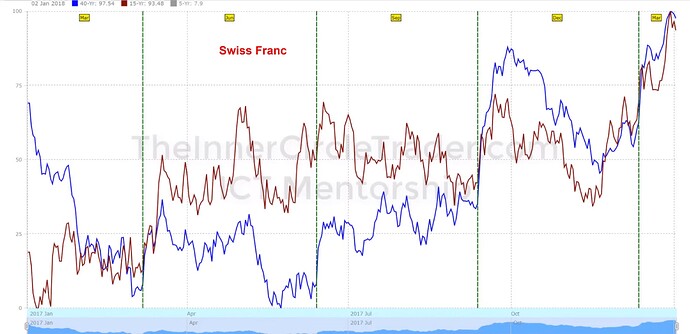

Swiss Franc Seasonal Tendencies

Swiss Franc COT - Commercials

USDCHF - Monthly Chart

USDCHF - Weekly Chart

USDCHF - Daily Chart

USDCHF - 4-Hour Chart

USDCHF - Hourly Chart

Gold Market Maker Buy Model - Accumulation

Gold Market Maker Buy Model - IOFED Buying Opportunity

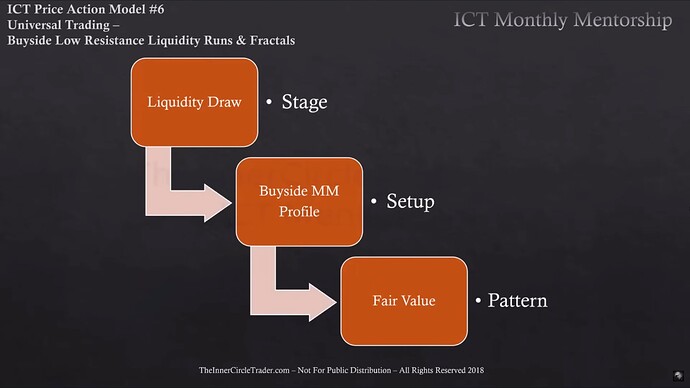

Buyside Of The Market Maker Models - Trade Stages

Preparation - Medium And High-Impact Events

Preparation - IPDA Data Range

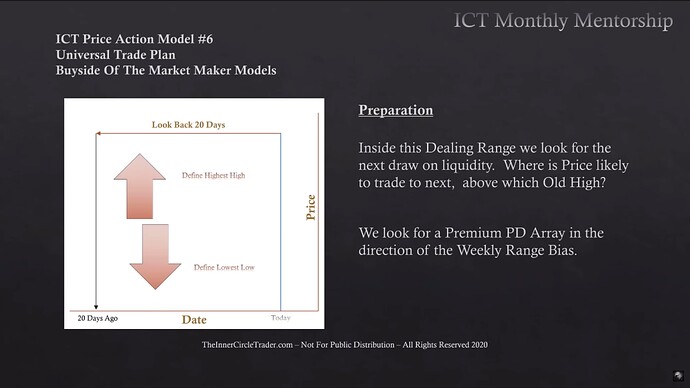

Preparation - PD Arrays

Preparation - Anticipation Of Price Movement

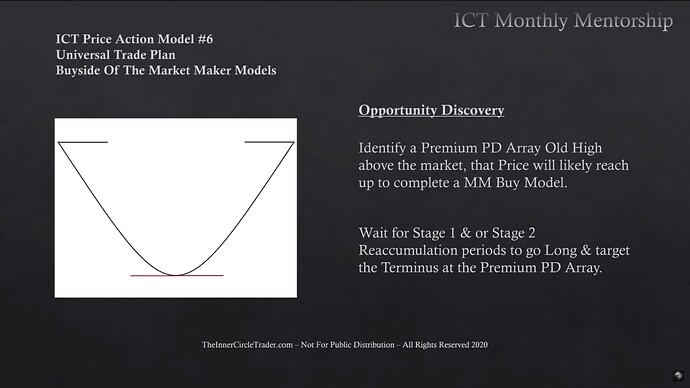

Opportunity Discovery - Buyside Of The Market Maker Sell Model

Opportunity Discovery - Buyside Of The Market Maker Buy Model

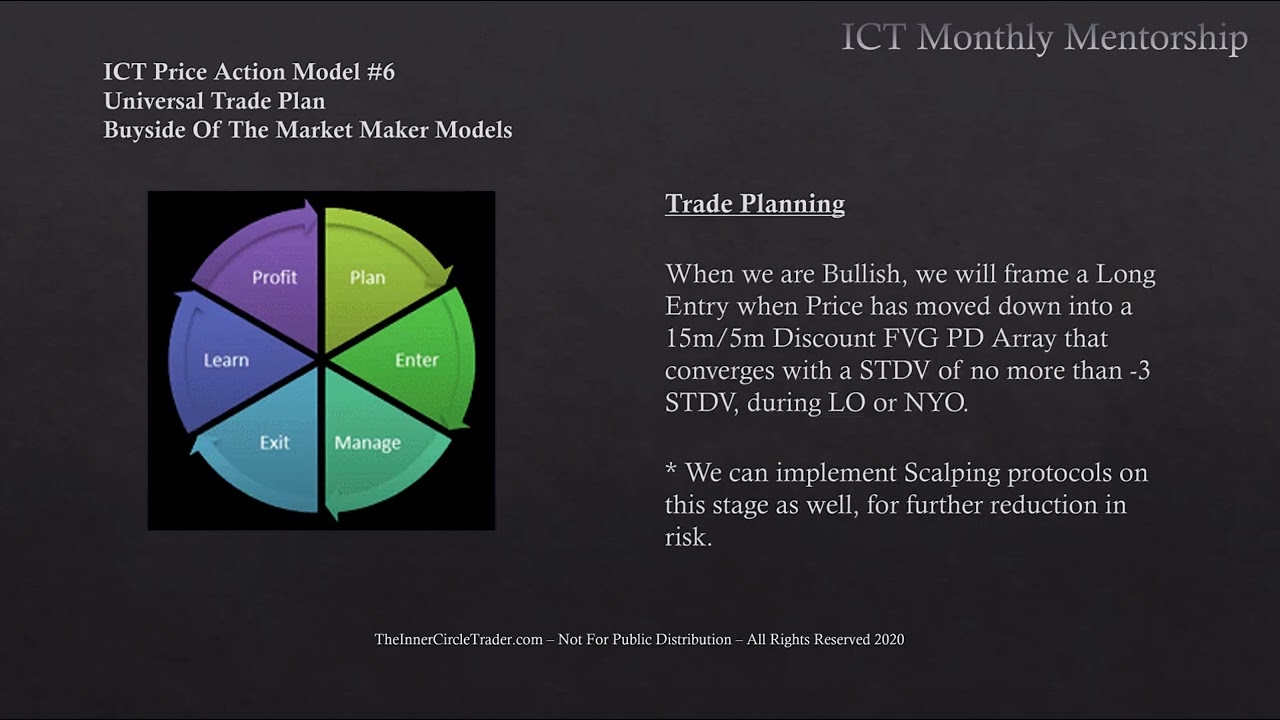

Trade Planning - Trade Setup

Trade Planning - Trade Setup 2

Trade Planning - Trade Targets

Trade Executions - IOFED And Stop Raid Trade Entry

Long Trade Management - Trade Entry

Long Trade Management - Trade Targets

Long Trade Management - Stop Loss

Stop Loss Management - Reduction Thresholds

Money Management - Position Size Calculation Formula

Money Management - Micro Lots

Money Management - Mini Lots

Money Management - Standard Lots

Money Management - Reducing Risk After Loss

Money Management - Reducing Risk After Win Streak

Backtesting

ES Example - Buy-Side Curve Of Market Maker Buy Model

ES Example - MMSM Without Retracements

ES Example - Market Maker Buy Model

ES MMBM Example - 15-Second Chart

Next lesson: ICT Price Action Model 7 - Universal Trading Model

Previous lesson: ICT Price Action Model 5 - Session Day Trading