Foundation Presentation

Supplementary Lesson

Trade Plan

Algorithmic Theory

Notes

- The Session Day Trading model focuses on finding setups during the London Open Kill Zone and New York Open Kill Zone. The Asian session can be used, but results are typically less effective.

- The strategy can be used on any day. However, Michael prefers Mondays, Tuesdays, and Wednesdays.

- The trading days with the highest probability are Tuesday and Wednesday, with potential trades extending into Thursday.

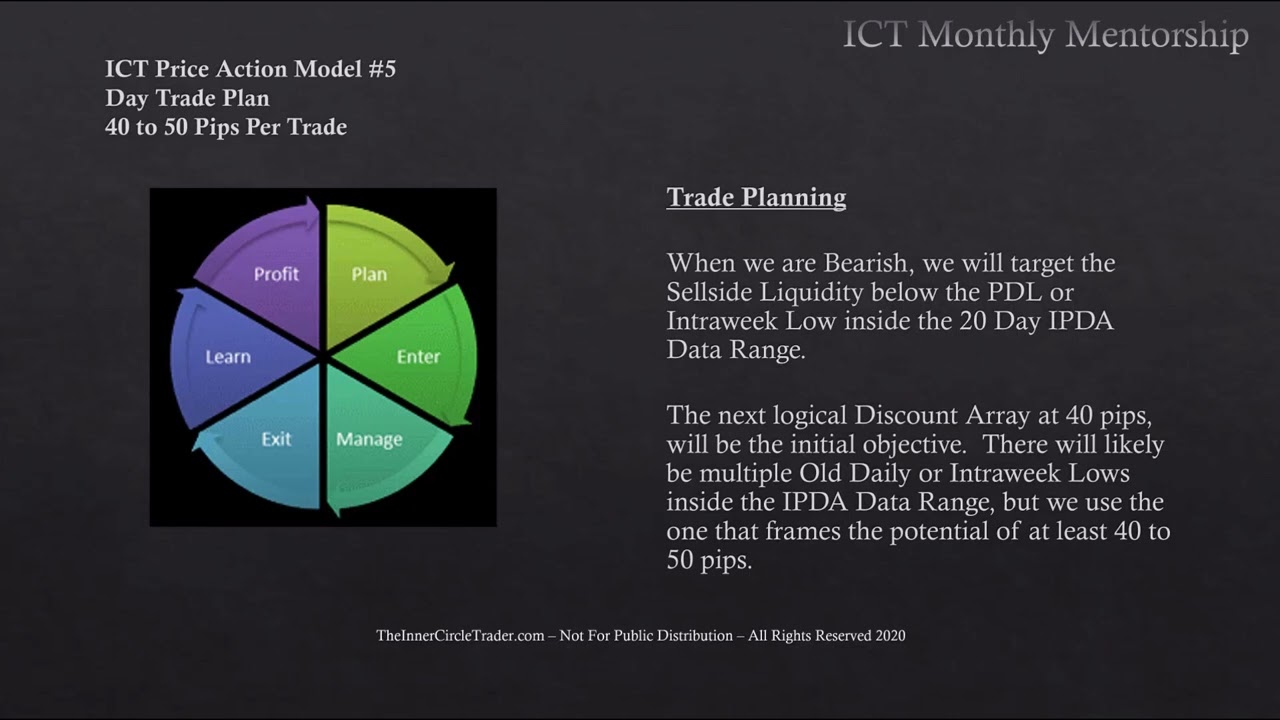

- It aims for 40 to 50 Pips per setup.

- We trade movements within individual sessions (e.g., London or New York) rather than trying to capture the entire daily or weekly range.

- The model supports various entry techniques, including Optimal Trade Entry (OTE), Turtle Soup, Fair Value Gaps, Order Blocks, Breakers or entry above or below open price (Power Of Three).

- The model encourages taking profits within the session, avoiding the risk of reversals, and not holding trades too long.

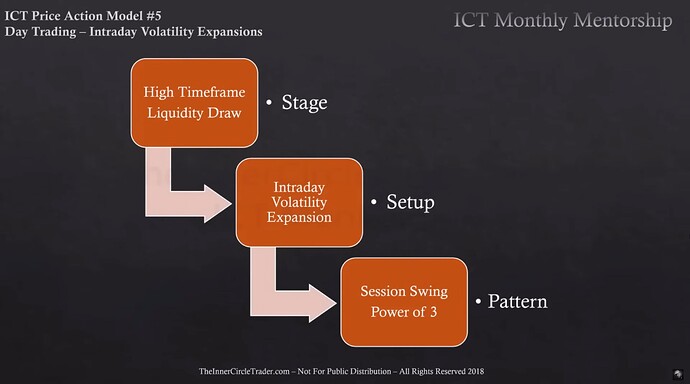

Session Day Trading - Process

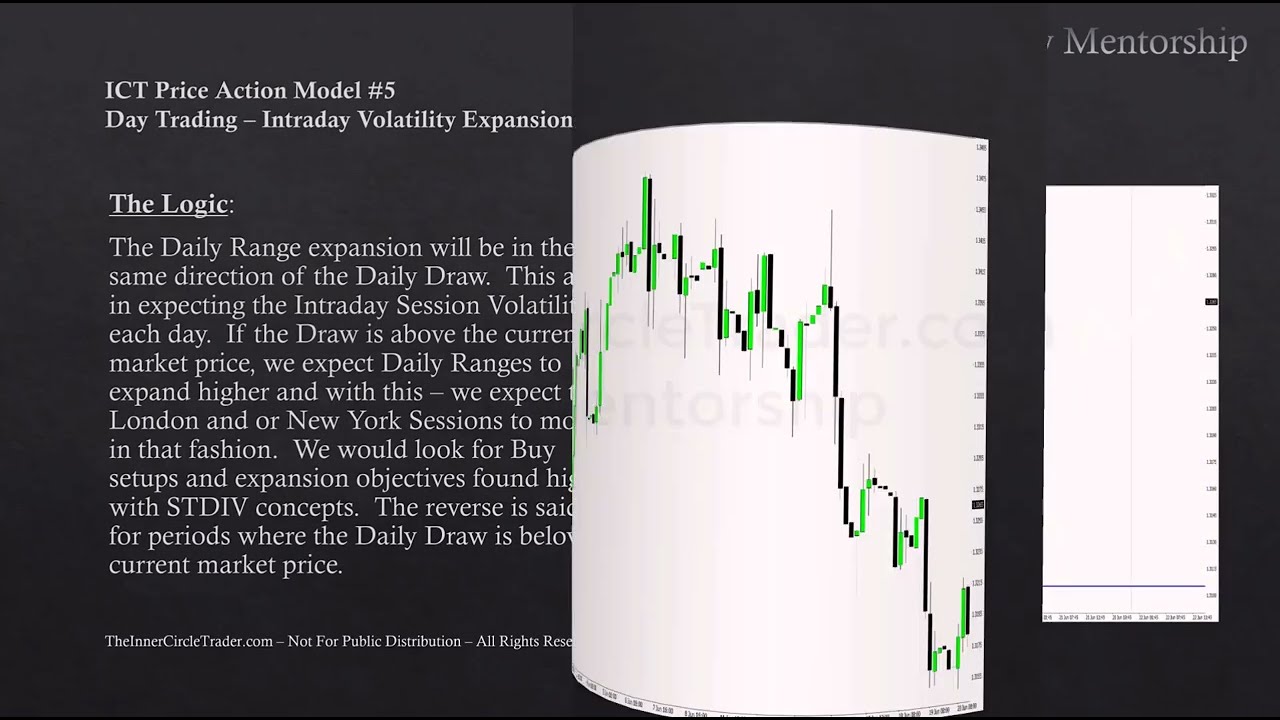

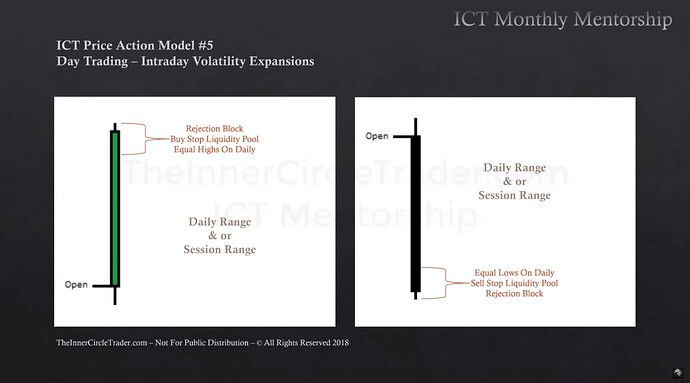

Session Day Trading - Intraday Volatility Expansions

Session Day Trading - The Logic

Session Day Trading - The Logic 2

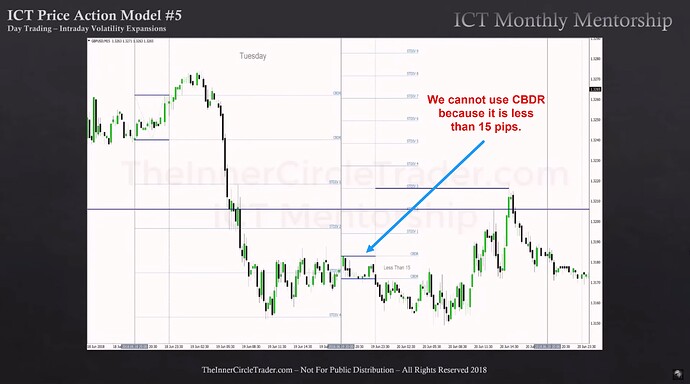

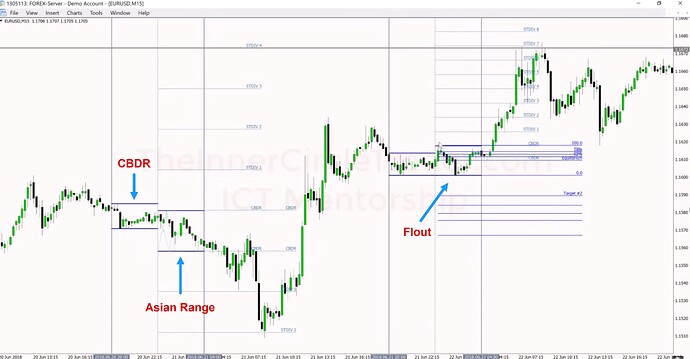

Session Day Trading - The CBDR Count

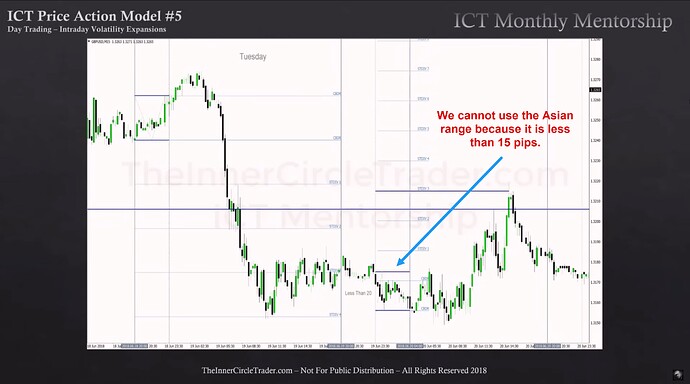

Session Day Trading - The Asian Range Count

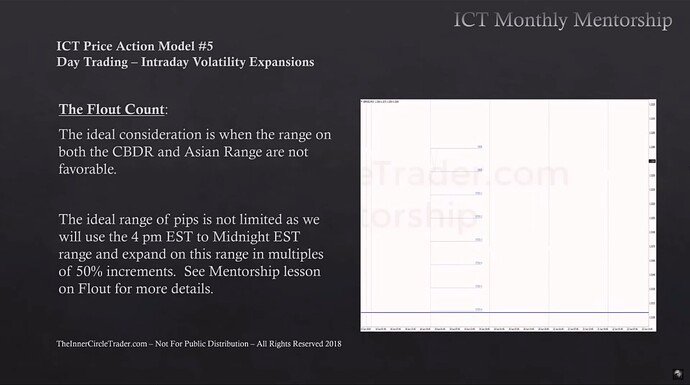

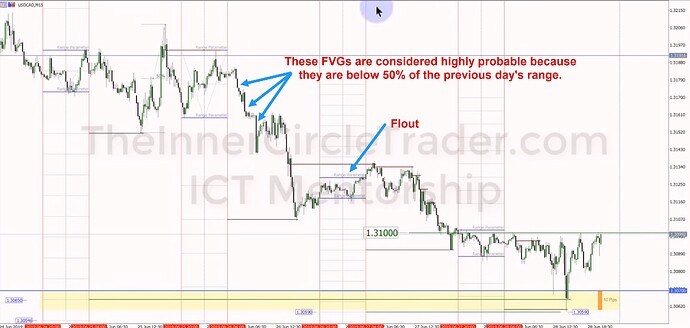

Session Day Trading - The Flout Count

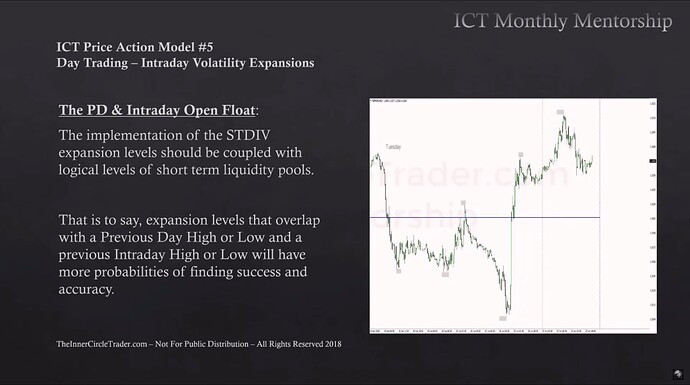

Session Day Trading - The PD And Intraday Open Float

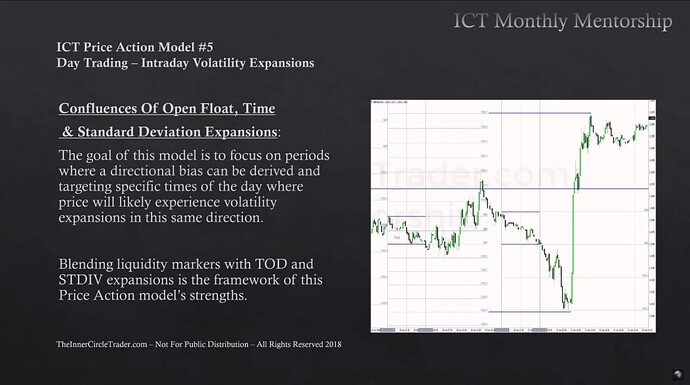

Session Day Trading - Confluences Of Open Float, Time And Standard Deviation Expansions

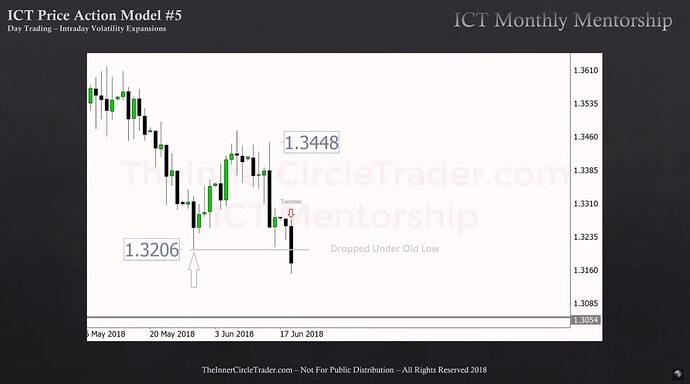

Session Day Trading - GBPUSD Example

Session Day Trading - Dollar Index

Session Day Trading - GBPUSD 15-Minute Chart

Session Day Trading - GBPUSD CBDR

Session Day Trading - GBPUSD Asian Range

Session Day Trading - GBPUSD Flout

Session Day Trading - GBPUSD Flout 2

Session Day Trading - GBPUSD Blending Liquidity Markers With TOD And STDIV Expansions

Session Day Trading - USDCAD Weekly Chart

Session Day Trading - USDCAD Daily Chart

Session Day Trading - Tradable FVGs

Session Day Trading - USDCAD 5-Minute Chart

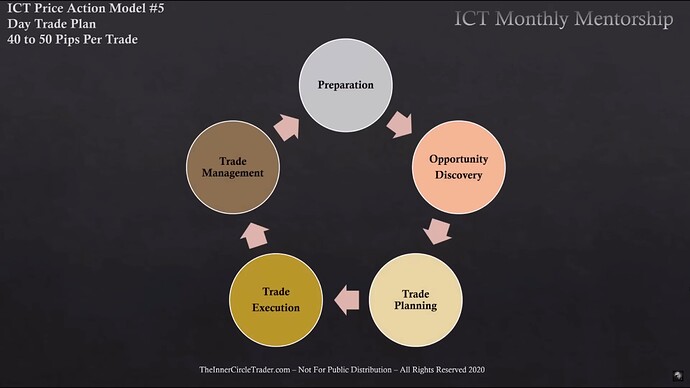

Session Day Trading - Trade Process

Preparation - Medium And High-Impact Events

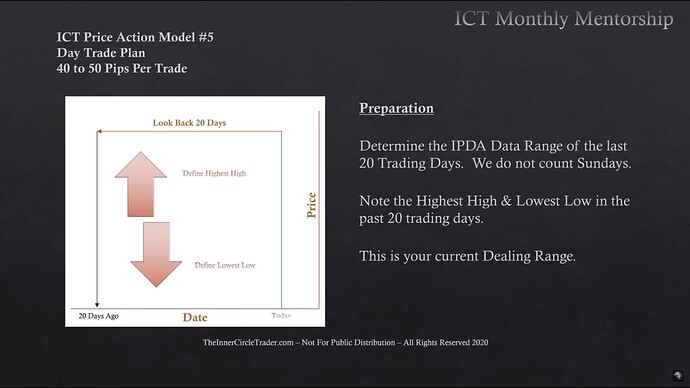

Preparation - IPDA Data Range

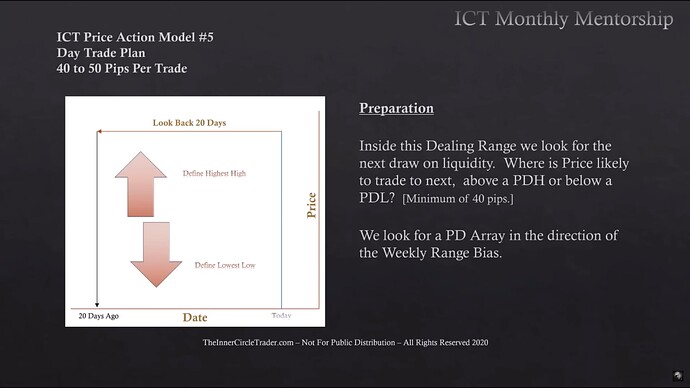

Preparation - PDH And PDL

Preparation - PD Arrays

Opportunity Discovery - Daily Range Expansion

Trade Planning - Shorting Premium FVGs And Buying Discount FVGs

Trade Planning - Bearish Conditions

Trade Planning - Bullish Conditions

Trade Planning - Bearish Targets

Trade Planning - Bullish Targets

Trade Executions - Bullish Conditions

Trade Executions - Bearish Conditions

Short Trade Management - Trade Entry

Short Trade Management - Trade Exit

Short Trade Management - Stop Loss

Long Trade Management - Trade Entry

Long Trade Management - Trade Exit

Long Trade Management - Stop Loss

Stop Loss Management

Money Management - Position Size Calculation Formula

Money Management - Micro Lots Example

Money Management - Mini Lots Example

Money Management - Standard Lots Example

Money Management - Reducing Risk After Loss

Money Management - Reducing Risk After Winning Streak

Backtesting

EURUSD Example - CBDR, Asian Range, And Flout

US Dollar Index Example - IPDA Ranges And Important Levels

US Dollar Index Example

GBPUSD Standard Deviations Example

AUDUSD Trade Example - Daily Chart

AUDUSD Trade Example - 15-Minute Chart

Next lesson: ICT Price Action Model 6 - Universal Trading Model

Previous lesson: ICT Price Action Model 4 - Position Trading